In March 2010, my first blog post in the music business research blog was entitled “The CD is Dead! Long Life the Music Download?” – with a question mark. The prophecy has become partly true. In some markets, e.g. in Sweden, the CD is only a by-product such as vinyl with a combined market share 12.4 percent (IFPI 2016: 92). In other countries, e.g. Germany, the CD is still economically relevant. Physical sales in Germany accounted for 60.0 percent in 2015 – with 83.6m CD units and 7.6m other physical units sold (ibid: 81). However, the CD is on the way to insignificance and will end up as a nostalgic collectors’ item. The following economic analysis of the international CD market shed light into the dynamics of different markets and explains, why some markets are still driven by CD sales.

The fate of the CD – an international CD-market analysis

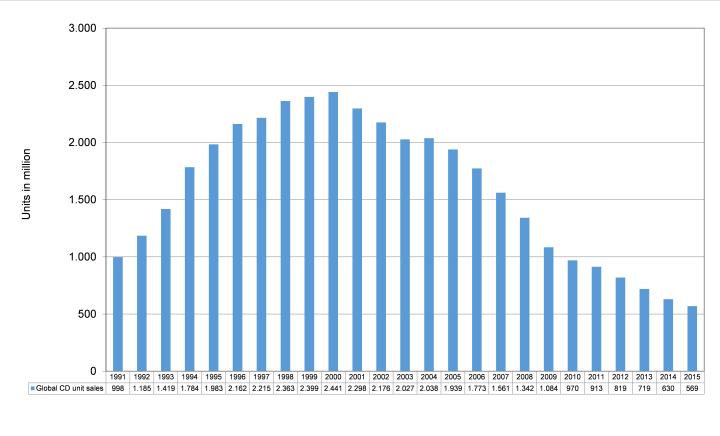

According to IFPI numbers, the global recorded music market decreased by 44.2 percent since 1999 to US $15.0bn in 2015. This tremendous revenue loss reflects the change from a physical to a digital music market. In 2014, the global digital music sales overtook physical sales accounting for a share of 45.8 percent of total recorded music sales (in trade value).

Figure 1: The global recorded music market (in million US$ trade value), 1997-2015

Source: After IFPI Recording Industry in Numbers, 1998-2015 and IFPI Global Music Report 2016.

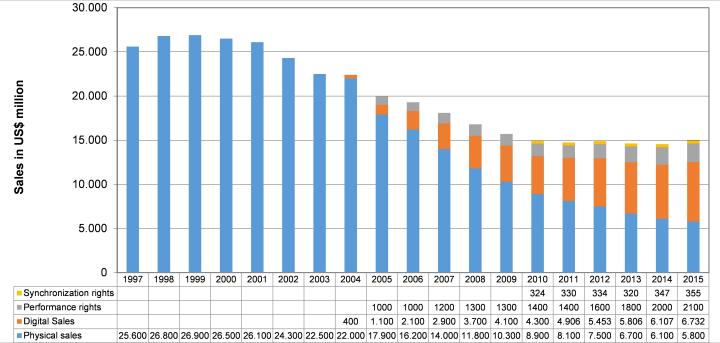

The CD-market segment

The decreasing CD sales caused the recession on the recorded music market. Whereas the CD unit sales boomed in the first half of 1990s with annual growth rates of about 20 percent, growth slowed down in the second half of the 1990s indicating the end of the CD’s life-cycle. CD album sales peaked in 2000 with 2.4bn copies sold. Since then the CD market decreased by 74.2 percent to 569m units sold in 2015. However, the downturn accelerated since 2005. Whereas the global CD market volume decreased by 20.6 percent from 2000 to 2005, it halved from 2005 to 2010 and further decreased by 41.3 percent from 2010 to 2015.

Figure 2: The global CD market segment from 1991 to 2015 (unit sales in million)

Source: After IFPI Recording Industry in Numbers, 1992-2015 and IFPI Global Music Report 2016.

Source: After IFPI Recording Industry in Numbers, 1992-2015 and IFPI Global Music Report 2016.

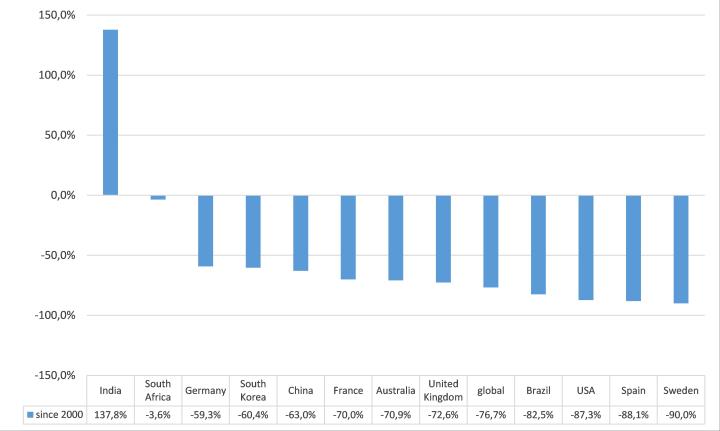

A closer look at national recorded music markets unveils different dynamics. Whereas Sweden lost 90.0 percent of CD unit sales from 2000 to 2015, the decrease of 59.3 percent in Germany was less severe in the same period. Outside Europe and North America some CD markets even have grown since 2000 such as India (+137.8 percent). However, India started at a very low sales level in 2000, when music cassettes still dominated the (legal) market. After a few years of growth, the CD segment halved from 2012 to 2015 from 41.6m units sold to 21.4m (IFPI 2016: 98). Thus, with a time-lag India follows the trend in large recorded music markets, which were literally smashed since 2000: France (-70.0 percent), UK (-72.6 percent), Brazil (-82.5 percent), and USA (‑87.3 percent).

Figure 3: The change rates of the CD market in selected countries, 2000-2015

Source: After IFPI Recording Industry in Numbers 2000 and IFPI Global Music Report 2016.

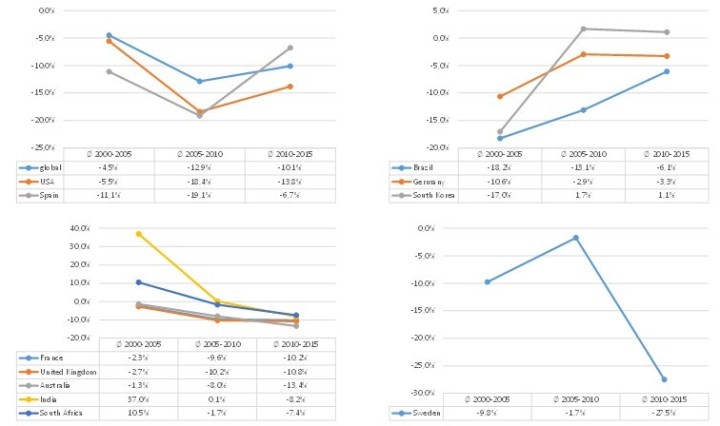

Different market dynamics

A differentiated look at three periods – 2000 to 2005, 2005 to 2010, and 2005 to 2015 – highlights different dynamics on national CD markets. Some countries such as the USA and Spain follow the global trend with modest annual average decreases from 2000-2005, accelerated loss rates from 2005 to 2010, and a slowed decrease since 2010. Other countries such as Brazil, Germany, and South Korea suffered from the most severe decreases in the period from 2000 and 2005 but recovered in the following decade. In South Korea, the CD segment even grew by an average of 1.7 percent from 2005 to 2010 and by 3.7 percent since 2010. Some countries experienced a growth of CD sales from 2000 to 2005 – India, China, South Africa – but with more or less severe losses in the following decade. However, a majority of countries such as Australia, UK, and France faced accelerated losses since 2000. Sweden is a special case. CD unit sales fell by 9.8 percent per year from 2000-2005. From 2005-2010 the annual loss of the Swedish CD market slowed down to 1.7 percent. In the following five years the CD market in Sweden collapsed with an annual decrease rate of 27.5 percent due to the widespread success of music streaming.

Figure 4: The average annual change rates of the CD market in selected countries, 2000-2015

Source: After IFPI Recording Industry in Numbers, 2000-2015 and IFPI Global Music Report 2016.

The analysis highlights that specifics of the national markets – such as availability of CD players, Internet and smartphone penetration, consumer behaviour, demographics, and cultural characteristics – caused different market dynamics. Thus, there is no simple explanation for the recession of the CD market.

Sweden and Germany in comparison

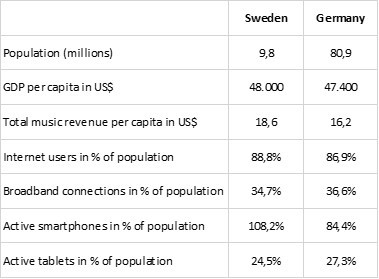

Despite the fact that Germany’s population is twice as large than in Sweden, both countries can be characterised by similar economic and technological indicators. The GDP per capita is about US$ 48,000 and the share of internet users, broadband connections and active tablets per head is similar. The total music revenues per capita in Sweden (US$ 18.6) and Germany (US$ 16.2) does not significantly differ. The only striking difference occurs in smartphone penetration. In Sweden each inhabitant owns a smartphone, whereas in Germany smartphone penetration is 84.4 percent. Nevertheless, Sweden and Germany are on a similar economic and technological level.

Figure 5: Sweden and German in comparison

After: IFPI Global Music Report 2016: pp. 81 and 92.

Thus, other factors have caused the different market dynamics in both countries. A view on the Swedish and German recorded music charts of 2015 helps to understand the differences.

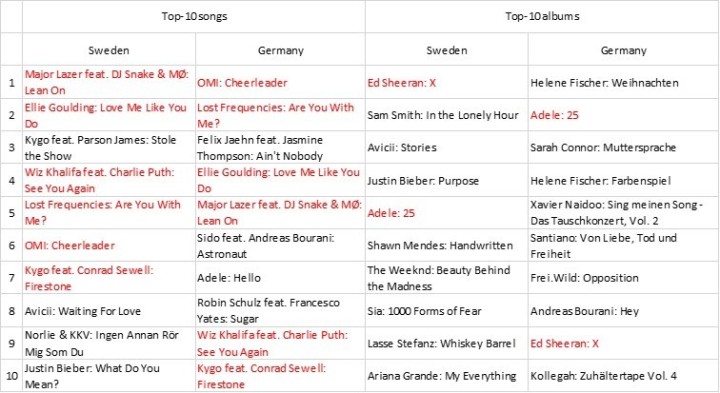

Figure 6: The Swedish and German top-10 charts

After: IFPI Global Music Report 2016: pp. 81 and 92; red indicates the same international products in both charts.

A comparison shows that more or less the same international hits dominate the top-10 of the Swedish and German single charts. A look at the album charts of both countries, unveils a significant difference in music taste. Only two international albums (by Adele and Ed Sheeran) can be found in both charts. Whereas the Swedish album chart is dominated by international products, the German hit list is dominated by domestic products, especially Schlager/popular folk music and Deutsch pop – the boundaries of both genres is blurring anyway. Particularly Schlager/popular folk music is popular among elderly people, who still buy CDs.

The current report of IFPI Germany (2016: 30) states that the generation 50+ has the highest sales share with 38.3 percent of total recorded music revenue in Germany. The report confirms that the oldest age cohort accounted for 64 percent of sales in the Schlager segment and for more than 66 percent in classical music segment, which is also highly relevant for the CD market. If we add the age cohort (40-49 years) to the picture we can see that the generation 40+ generated almost 68 percent of all CD-sales in 2015 (IFPI Germany 2016: 32-33). By comparing the economic relevance of album and therefore mainly CD-driven genres – Schlager/popular folk music, Deutsch pop, classical music, jazz –, which accounted for 21 percent of overall recorded music sales in Germany (ibid: 39) – with the music consumption behaviour of the older age cohorts, we can conclude that elderly music consumers account for the still relatively high sales share of the CD-format in Germany. Thus, we can expect a further decline of the CD segment in Germany, which could result in decreasing overall recorded music sales if the growth of streaming revenue cannot compensate for the loss in CD sales as well as download sales. Whereas in Sweden recorded music revenue will further grow as long as the streaming boom continues.

Thus, the comparison of the Swedish and German CD markets highlights that there is no uniform a simple explanation for market dynamics and we have to take into consideration macroeconomic, technological, demographic and cultural factors to assess the future development of different national recorded music markets.

Sources:

IFPI, 2016, The Global Music Report 2016, London.

IFPI Germany, 2016, Musikindustrie in Zahlen 2015, Berlin.

4 thoughts on “The fate of the CD – an international CD-market analysis”