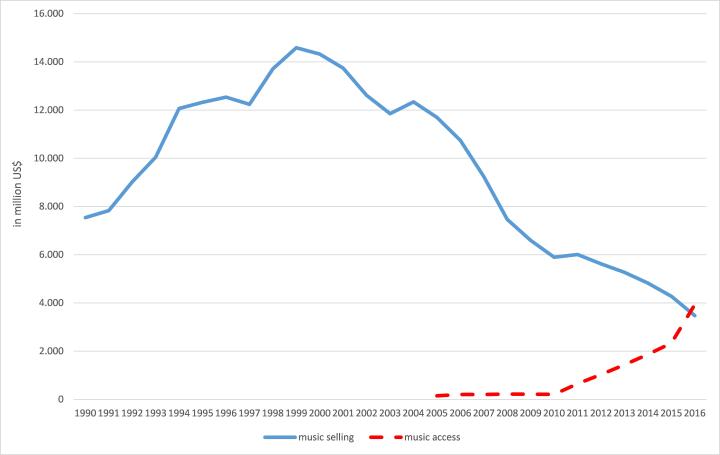

The music business year 2018 was shaped by the ongoing streaming boom. In April, Spotify has been listed as a stock market company and shortly thereafter the International Federation of the Phonographic Industry (IFPI) reported a 41.1 percent increase of global music streaming revenue to US $6.6bn for 2017. Music streaming has become the most relevant revenue source with a market share of 38 percent in the phonographic industry (compared to physical sales 30 percent, downloads 16 percent, performing rights 14 percent and synchronisation rights 2 percent).

In 2011, the global revenue from music streaming was comparatively low with a market share of 4.1 percent and a revenue of US $600m. However, the countries, for which IFPI provides data, have not developed uniformly as highlighted in the following analysis.